Get This Report on Paul B Insurance Medigap

Table of ContentsWhat Does Paul B Insurance Medigap Mean?Not known Facts About Paul B Insurance MedigapPaul B Insurance Medigap Things To Know Before You Get This3 Simple Techniques For Paul B Insurance MedigapThings about Paul B Insurance Medigap

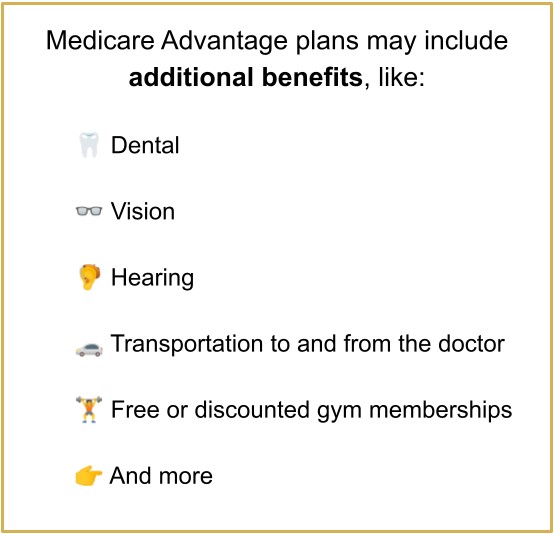

Some plans might supply more benefits than are covered under Original Medicare. MA plans are annual contracts. Plans might decide not to negotiate or restore their agreements. Strategies might alter benefits, boost premiums and increase copayments at the start of each year. You may have higher yearly out-of-pocket expenses than under Original Medicare with a Medicare supplement (Medigap) strategy.Most of the times, you can not keep your stand-alone Medicare Part D strategy and the Medicare Advantage plan. Compare Medicare Advantage prepares to Medigap prepares Medicare Advantage plans, Medigap strategies, Exist out-of-pocket costs? More out-of-pocket costs, however may have lower premiums, Fewer out-of-pocket expenses, but may have greater premiums, Where can I use the plan? Functions only in your state, by area or county, Works in any state, Do I need to use the plan's network of providers? Must use a service provider network, No supplier network required unless you purchase a Medigap Select plan, Does the plan include prescription drug protection (Part D)? The majority of plans cover Medicare Part DMedicare Part D not included Ask your medical providers If they'll take the MA plan.

If you reside in another state part of the year, discover if the strategy will still cover you. Lots of plans require you to utilize regular services within the service location (other than for emergency care), which is usually the county in the state where you live. Learn if the plan includes: Month-to-month premiums, Any copayments for numerous services, Any out-of-pocket limits, Costs to use non-network companies, If you have Medicaid or get long-term care, or reside in an assisted living home, Unique Needs Plans may be readily available in your location.

Some Known Factual Statements About Paul B Insurance Medigap

In-network providers bill the plan correctly and/or refer to Medicaid companies as needed. The service providers' workplace understands what Medicaid covers and what the strategy covers.

This implies that your doctor actively interact to coordinate your care between various types of health care services and medical specializeds. This guarantees you have a health care team and assists avoid unnecessary expenditure and issues like medication interactions. In one, scientists found that collaborated care was connected with greater patient ratings and more positive medical staff experiences.

Our Paul B Insurance Medigap PDFs

If you choose one of the more popular Medicare Benefit strategy types, such as an HMO plan, you may be limited in the suppliers you can see. You will usually deal with higher charges if you select to an out-of-network service provider with these strategies. Other strategy types do provide you more service provider freedom, though those plans might have greater premiums and fees like copays and deductibles.

This suggests that if you move to a new service location, your present Medicare Advantage plan might be unavailable. Selecting the finest Medicare Advantage plan for your requirements can be made complex.

The info on this website might help you in making personal decisions about insurance, however it is not meant to provide suggestions concerning the purchase or usage of any insurance or insurance items. Healthline Media does not negotiate the organization of insurance coverage in any way and is not certified as an insurance coverage company or manufacturer in any U.S.

The Basic Principles Of Paul B Insurance Medigap

Healthline Media does not recommend or back any 3rd celebrations that may transact the business of insurance coverage.

People with traditional Medicare have access to any doctor or hospital that accepts Medicare, anywhere you can look here in the United States. All Medicare Advantage strategies are needed to have such networks for medical professionals, medical facilities, and other providers.

A 2017 analysis found that Medicare Advantage networks consisted of fewer than half (46%) of all Medicare doctors in a provided county, typically. The Centers for Medicare and Medicaid Services (CMS), which administers Medicare Advantage prepares, has actually specified that it will reinforce its oversight of plan networks beginning in 2024, based in part on an analysis finding that some strategies were not in compliance over the last few years with "network adequacy" standards. Nearly all Medicare Advantage enrollees are needed to acquire prior approval, or permission, for protection of some treatments or services something typically not required in traditional Medicare. Strategies that need previous permission can approve or reject care based on medical research study and requirements of care. For services exempt to previous permission, strategies can reject protection for care they deem unnecessary after the additional info service is gotten, as long as they follow Medicare coverage guidelines and guidelines.

Paul B Insurance Medigap Can Be Fun For Anyone

Medigap plans cover a number of the extra costs not covered by conventional Medicare for example, the 20 percent copayment for many regular Part B medical professional's services. paul b insurance medigap. Some Medigap plans also consist of services not covered by traditional Medicare, such as access to oral care or glasses. Medigap protection is supplied through private insurance providers.